schedule c tax form calculator

If you have a loss check the box that describes your investment in this activity. This calculator assumes that none of your long-term capital gains come from collectibles section 1202 gains or un-recaptured 1250 gains.

Schedule C Instructions With Faqs

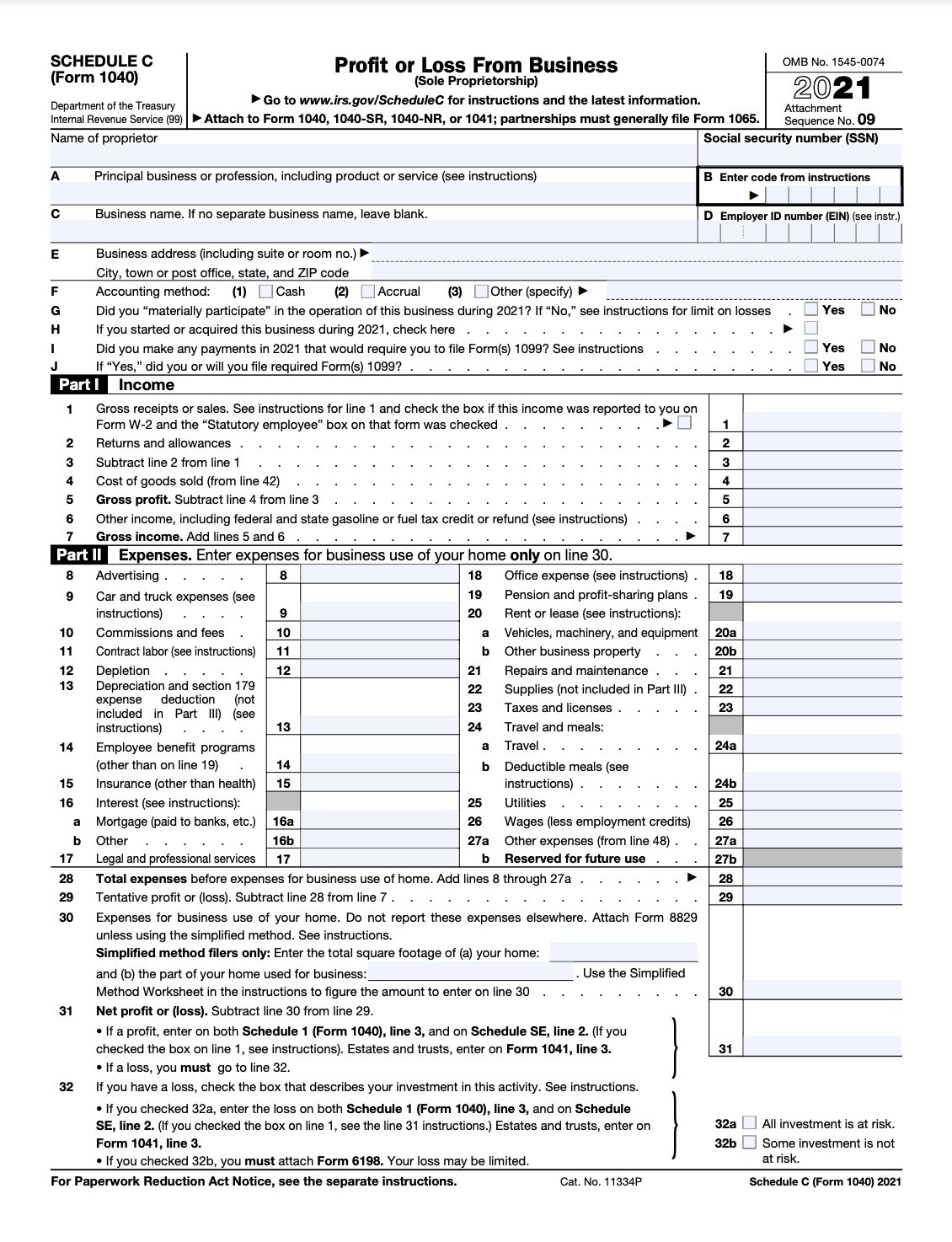

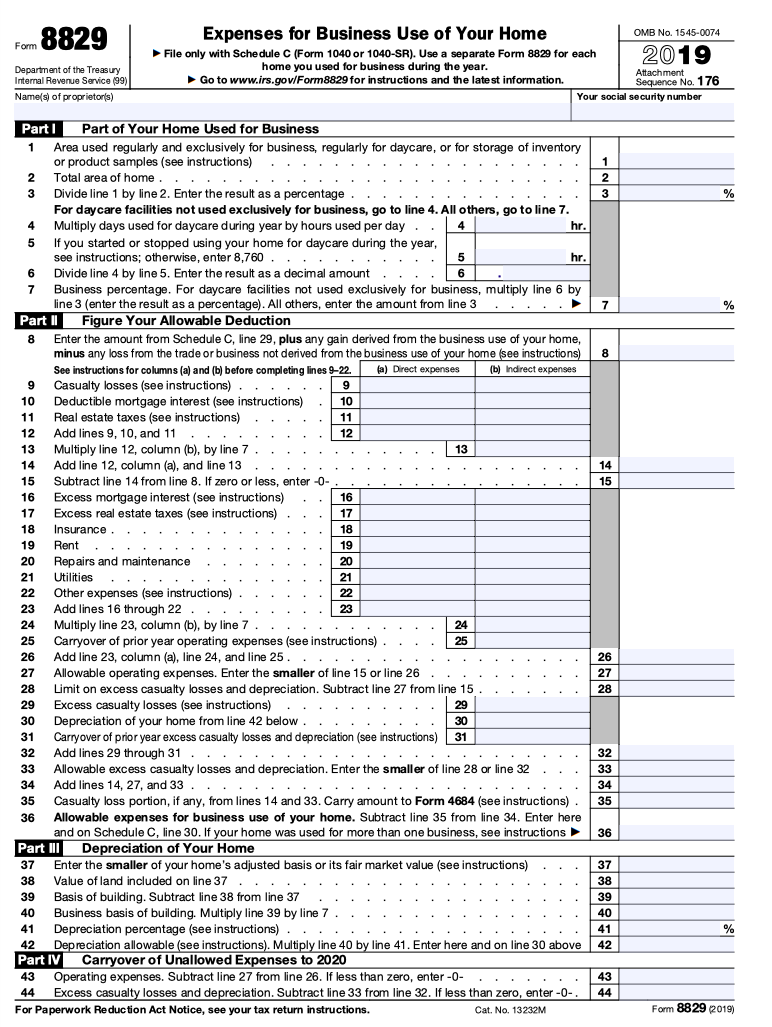

You may also need Form 4562 to claim depreciation or Form 8829 to.

. Go to line 32 31 32. Net Profit from Business. Form 1040 Schedule C-EZ.

Form 1041 line 3. File your 1040 with a Schedule C for free. This is your total income subject to self-employment taxes.

However you can deduct one-half of your self. Self-Employed defined as a return with a Schedule CC-EZ tax form. If you checked 32a enter the.

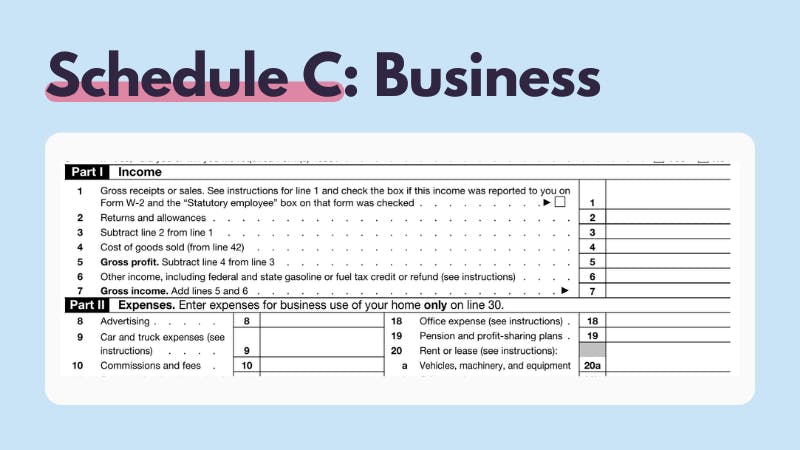

About Form 1041 US. If a loss you. Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor.

Based on your projected withholdings for the year we can also estimate your. Online competitor data is extrapolated from press releases and SEC filings. If you received any 1099-NEC 1099-MISC or 1099-K tax forms reporting money you earned working as a contractor or selling stuff youll have to report that as income on Line 1 of.

1040 Tax Calculator Enter your filing status income deductions and credits and we will estimate your total taxes. This means that youll multiply your net earnings by 01530 to arrive at the amount of self-employment tax you need. Use Tax Form 1040 Schedule C-EZ.

This is calculated by taking your total net farm income or loss and net business income or loss and multiplying it by 9235. Share E-Sign Instantly. Income Tax Return for Estates and Trusts.

Online competitor data is extrapolated from press releases and SEC filings. If you file using a software install our plug-in and well tell you the numbers you should enter at every step to prepare your taxes. Ad Access IRS Tax Forms.

If the total of your. Ad Edit Sign Print Fill Online more fillable forms Subscribe Now. Self-Employed defined as a return with a Schedule CC-EZ tax form.

Up to 7 cash back The current rate of self-employment tax is 1530. Federal filing is always free for everyone. Information about Schedule C Form 1040 Profit or Loss from Business.

These types of capital gains are. About Form 1099-MISC Miscellaneous Income. Online is defined as an individual income.

Ad Write A Form Schedule C With Our Premium Fillable Templates- Finish Print In Minutes. Usually people who file a Schedule C Tax Form will also have to file a Schedule SE Tax Form. Ad Over 50 Million Returns Filed 48 Star Rating Claim all the credits and deductions.

If you have a tax advisor or. Make tax season a breeze. Report your income and expenses from your sole proprietorship on Schedule C Form 1040 Profit or Loss from Business Sole Proprietorship.

Complete Edit or Print Tax Forms Instantly. A self-employed individual who pays state and local taxes with respect to business income reported on Schedule C or E can deduct them only as an itemized deduction on. Net Profit from Business as a stand alone tax form calculator to quickly calculate specific amounts.

Plan contributions for a self-employed individual are deducted on Form 1040 Schedule 1 on the line for self-employed SEP SIMPLE and qualified plans and not on the. After computing your current years depreciation deductions total them in Part IV of Form 4562 and copy the number to the Schedule C line for. Get Trusted Legal Forms.

Online is defined as an individual income. A Schedule C is a tax form filed with your personal tax return that helps you calculate the profit or loss from your business. Schedule C is an important tax form for sole proprietors and other self-employed business owners.

Its used to report profit or loss and to include this information in the owners. Complete the Process. Use it to tell the government how much you made.

How To Fill Out Form 8829 Bench Accounting

Free 9 Sample Schedule C Forms In Pdf Ms Word

Free 9 Sample Schedule C Forms In Pdf Ms Word

What Is A Schedule C Tax Form H R Block

Free 9 Sample Schedule C Forms In Pdf Ms Word

Schedule C Form 1040 Sole Proprietor Independent Contractor Llc How To Fill Out Form Schedule C Youtube

Schedule C Income Mortgagemark Com

Irs Crypto Tax Forms 1040 8949 Koinly

What Is A Schedule C Tax Form H R Block

How To Fill Out Your 2021 Schedule C With Example

How To Fill Out Your Schedule C Perfectly With Examples

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

How To Fill Out Your 2021 Schedule C With Example

Schedule C Instructions Easy Step By Step Help

Schedule Se A Simple Guide To Filing The Self Employment Tax Form Bench Accounting

How To Fill Out Your 2021 Schedule C With Example

What Do The Expense Entries On The Schedule C Mean Support